Half of our job is education. We want you to be “in the know” when it comes to the energy market. It is important to us that our clients understand the “why’s” behind a rate. This is why we post energy updates; so our clients can understand when to buy in, how much to buy, and upcoming trends.

December 2024: Most Natural Gas Since 2016 (U.S.)

A cold start to December gave way to a prompt warm-up, which will hold near-term gas futures that settled at $3.21/MMbtu.The winter outlook provided by the EIA predicts that this heating season’s inventories will be 6% above the 5-year average, barring any extreme weather conditions.

April 2024: Gas Production Down

“Prices are historically low due to weak winter demand amid milder weather, record output at the end of 2023, and higher-than-average natural gas stocks”

Expectant: “Henry Hub natural gas price of $2.59 per million British thermal units (MMBtu) at year-end, compared to an average price of $1.44 per MMBtu through most of March…”

Source: Oilprice.com

January 2024: New Year Updates

Natural Gas: 12-month strip is down 17 cents from 3.07 to 2.90

Source: Nick Gerome, CTA

August 2023: Money Moves

As fears of a global recession resurface, the energy markets remain elevated. The Bank of England followed the US and Japan by implementing another interest rate hike, the highest level since 2008.

Source: Nick Gerome, CTA

April 2023: Oil Market Changes

Because of the banking crisis, oil prices increased, which pushed OPEC to announce plans of cutting production by 1Million barrels/day.

Source: Nick Gerome, CTA

February 2023: Natural Disaster

Early February started with the devasting 7.8 magnitude earthquake that struck Turkey and Syria. The disaster caused oil flows to stop in the region as well as reduced outflows to the Mediterranean coast.

Source: Nick Gerome, CTA

January 2023: NG Down 33% from December

As seen in our last market update from December, NG prices are now down 33% (from 12/19/22).

Source: Nick Gerome, CTA

Natural Gas Chart

December 2022: Gas Prices Fall

Weather pushes NG prices down as the US expects a warm winter. “Natural gas prices in Europe have now come down to levels previously seen before the Russia-Ukraine war.”

August 2022: Upward Momentum for EU Gas Prices

Causes for Rally:

- Russia stopping gas flow

- Cold winter with not enough output

What this means for the US – pressure on gas prices as higher-than-normal European export demand is expected to continue, while domestic supplies remain below the 5-year average.

Sources: Nick Gerome, CTA, Taurus Advisory Group & www.reuters.com

May 2022: Upward Trend of Energy Prices

Market Impactors:

- Russia conflict with Ukraine

- Lack of fuel sources

- Interest rate increase

- Bounce back from COVID

How to combat – Lock in non-commodity energy components with future heading plans to capture market dips

As we can still see an upward trend in power prices, there is a downward trend in national REC pricing

May 2021: Natural Gas-Fired Generation On The Decline

- The Power Move blog article- https://etekenergy.com/market-update-natural-gas-fired-generation-on-the-decline/

Sources: U.S. Energy Information Administration, Nick Gerome, CTA, Taurus Advisory Group

November 2020: Managed Energy Buying for Future Markets

- The Power Move blog article- https://etekenergy.com/a-managed-approach-to-energy-buying/

Source: Direct Energy

August 2020: Natural Gas on the Rise

- The Power Move blog article- https://etekenergy.com/august-energy-briefing-natural-gas-on-the-rise/

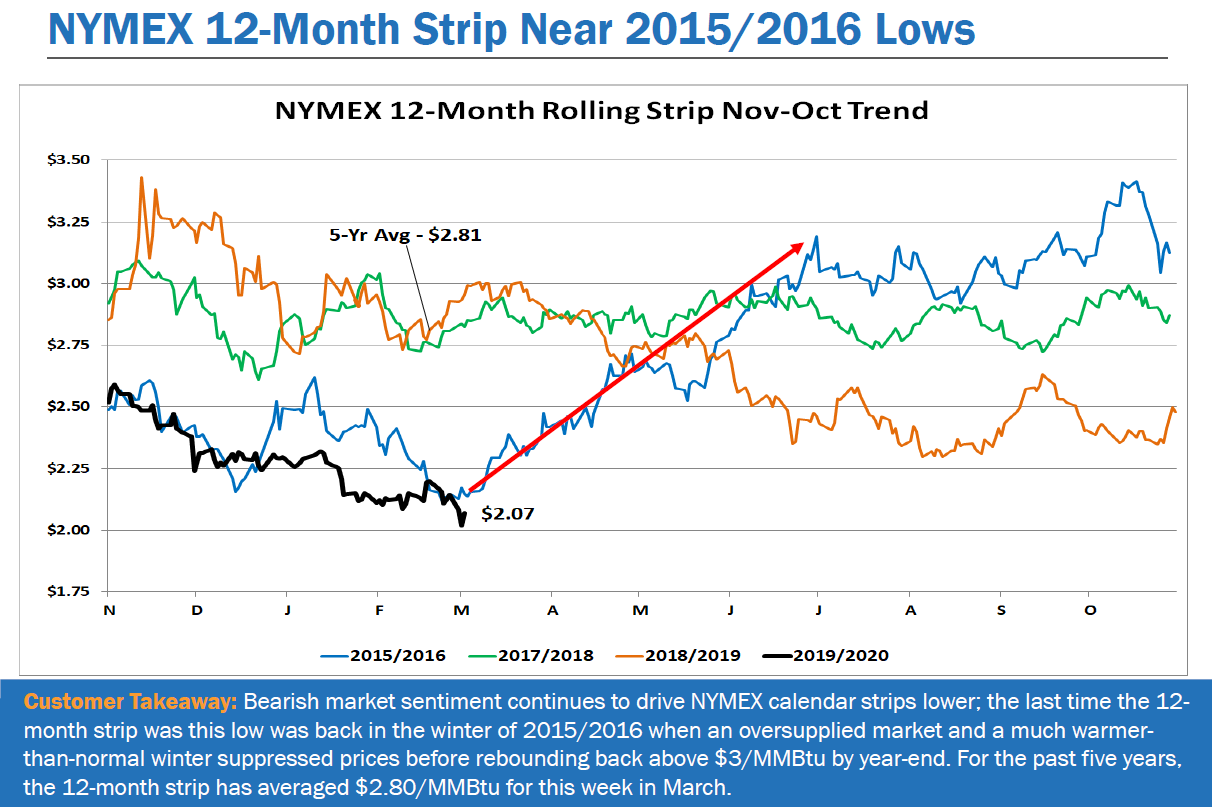

March 2020: NYMEX 12-Month Lows

Mild winters coupled with COVID-19 push the energy market to lows last seen in 2015-2016. NYMEX 12-month strips are currently averaging $2.07/MMBtu, while the past 5 years has averaged $2.80/MMBtu.

Market Update: NYMEX

Jan 2020: PSE&G, Met-Ed, & Penelec - Transmission Increase

Links:

- The Power Move blog article- https://etekenergy.com/market-update-new-year-new-energy-market/

Jun-Sept 2019: Market Low for Natural Gas

Links:

- The Power Move blog article- https://etekenergy.com/energy-in-a-nutshell/

- EnergyWatch- https://energywatch-inc.com/natural-gas-storage-experiences-largest-withdrawal-of-the-season/