Fix or Not to Fix, That Is the Question

“If you sell on savings, you die on savings,” says Etek COO Nicholas Gerome- and he’s right. Per usual, our forward look of the market hits the nail on the head with the volatility expected to come in 2021. So the question all commercial energy users should be asking is how can I manage both my energy risk and utility budget? The answer: through a layered and managed approach that incorporates a block and index product.

Let’s take a step back and look at energy procurement a few years back. The go-to was a fixed product for terms of 24-48 months because a low and even-keeled market meant that buying long strips of energy provided more savings and a whole lot more protection. All-in fixed products, where your transmission and capacity charges are locked instead of passed through, gave price point certainty but lesser savings than if you played the market; strategically of course. Long term contracts with competitive rates then swapped with 1-year contracts as energy suppliers wanted to minimize their risk by forcing users to go for shorter terms as the market became more volatile. Now, as we approach 2021 with still advantageous price points to grab before 2020 is officially over, commercial energy users need to switch their outlook on supply contracts from a savings only approach to a savings/strategy hybrid.

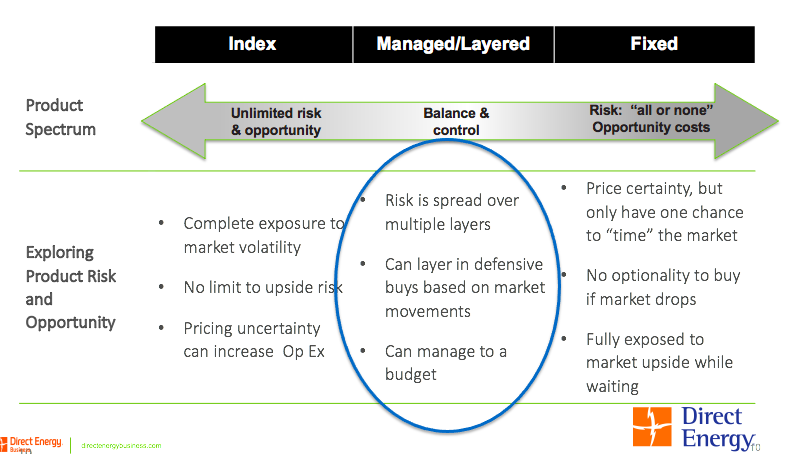

Instead of fixing your entire energy contract for x years, buy 25-75% of your contract with the option to fully fix all rate components. This layered approach provides optionality and multiple chances to time market buys instead of in one shot. You can hedge your energy contract by percentages or timed-buying (contracted for 10 months, back to the utility for 2, repeat) to best position your company in the market. See below the difference in managed energy products from Direct Energy.

Direct Energy

Written by Eva Gerrits

Source: Direct Energy

Leave A Comment