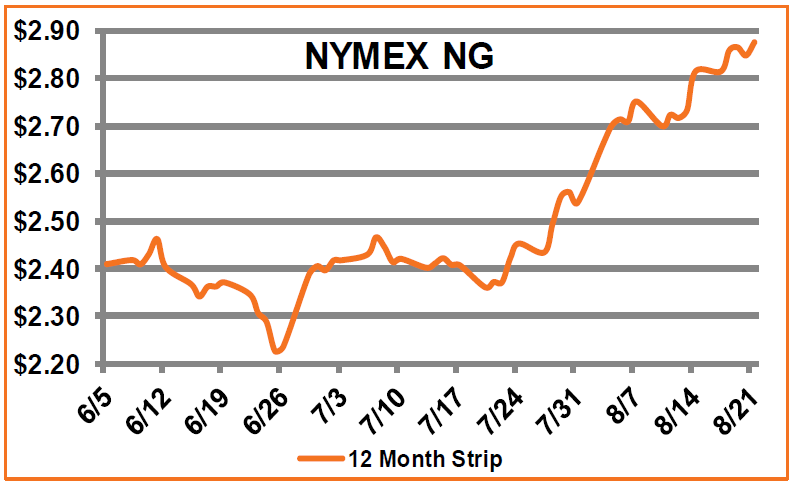

*graph source Direct Energy

You know how the saying goes, “no news is good news?” That phrase rang true when last week’s bearish markets bled into this week with the New York Mercantile Exchange (NYMEX) reporting a 70-cent increase of the price for the 12-month strip (September 2020 – August 2021) from $2.20-$2.90. This is not a positive indicator as we are knee-deep in hurricane season and the looming economic effects of COVID-19 are starting to settle in. It also doesn’t help that the total consumption across the U.S. for natural gas increased by 1.5% compared to the previous week. Natural gas consumed for power generation has climbed 1.8% week over week. In order to understand, or at the very least analyze this volatile market, we need to dive into some of the geopolitical factors that are driving this upswing.

West Coast: A heatwave and wildfires in California have put electric and the need for air conditioning in high demand. CA is currently plagued with frequent blackouts due to the lack of power plants in the state. With most of their power being generated by renewables, the grid cannot support the high demand. Cue Texas. Because of the increased demand, California is forced to import energy from Texas plants – driving the price of energy up in Texas simultaneously. This situation has led to unpredicted withdrawals from our natural gas storage.

East Coast: Lower than normal temperatures have halted demand on the east coast.

Supply is Down: The heightened demand in CA and the fact that Credit Suisse Group plans to liquidate inverse natural gas traded contracts have decreased natural gas supply by .2%

Halted Production: Because of the surplus of supply, lack of storage, and minimal demand due to COVID, drilling for natural gas has severely decreased. This is also paired with a couple of tropical storms bearing on the Gulf of Mexico – decreasing production by an additional 40%.

What can we expect from the energy market in the near term?

Inflation due to the impact of the economic shutdowns will usher in a week dollar and increased prices. This will also result in lowered demand, making the market even more volatile. Winter will bring an La Nina, the opposite of an El Nino – cold surface water temperatures which creates a wet and warm climate to its east. This might be our only saving grace. The Farmer’s Almanac is predicting a more mild and temperate winter for most of the U.S., which will provide the only relief for the volatile market we are promised to have.

Written By: Kristin DeBias

Sources: Nicholas Gerome, Taurus Advisory Group; Christopher Lewis, FXEmpire; Bloomberg; US Energy Information Administration

Leave A Comment