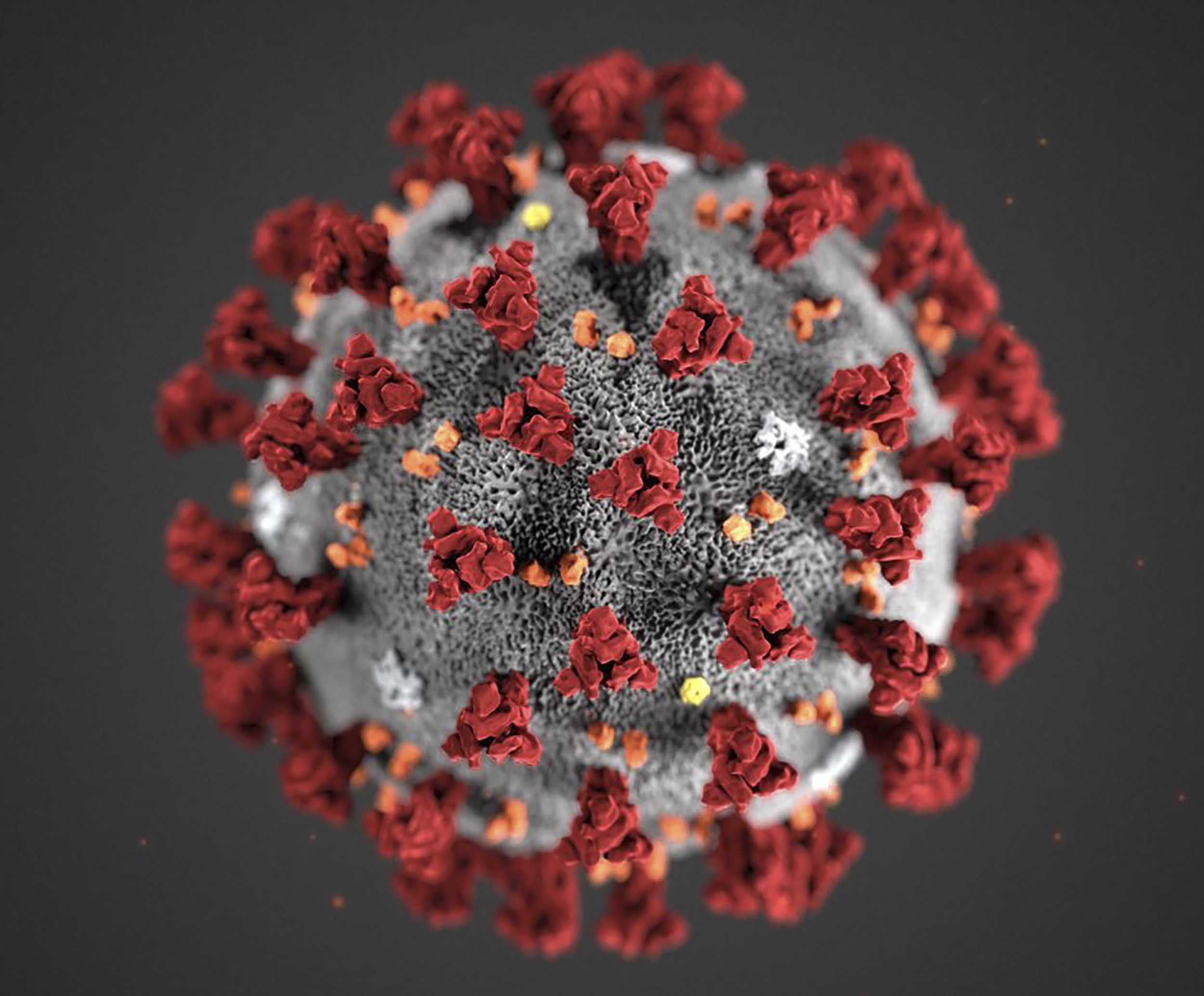

The Coronavirus has threatened not only global health, but global economy. How does this affect your energy buying? Well here is the run down…

- Because oil prices are so low, will this bring down my natural gas price?

Great question. The short answer? It’s complicated. The reason? Well in short, supply and demand comes into place. Normally, lowered oil prices would lower natural gas prices because natural gas prices are based off of the oil market. HOWEVER, due to the extremely moderate winter, the USA’s natural gas supply is overflowing. We have so much excess supply that the lowered oil prices will barely affect them. Suppliers have already succumbed to bottom of the barrel pricing. So much so that we are going to slow natural gas production which will level out pricing.

- How long will it take for the market to bounce back?

Global analysts expect the market to bounce back but probably not this year. One Goldman Sachs analyst doesn’t predict a comeback until at least 2021. Which is likely when demand will finally catch up with supply. Even Jerry Jones cut down his oil drilling from using 9 rigs to 6 rigs.

- How will oil companies combat the ongoing crisis?

Oil companies are already slowing production. Why produce and sell product in a losing market? The short answer? You don’t. You slow production for the remainder of 2020 or until most of supply is sold off. While the remaining supply will likely increase due to increasing demand, at the same time production will be driving oil prices up.

Long story short, the current pricing market is lined with gold. Already being in a shoulder month (season where extreme heat is not prevalent), the current pricing market proves that there is money to be made and money to be saved. We are at the bottom of the proverbial barrel. Meaning, before prices increase (even slightly) due to cooling demands, buy the bulk of your energy in March/April and buy in longer terms.

Written by: Kristin DeBias

Well written and extremely informative!

Thanks Jay!!