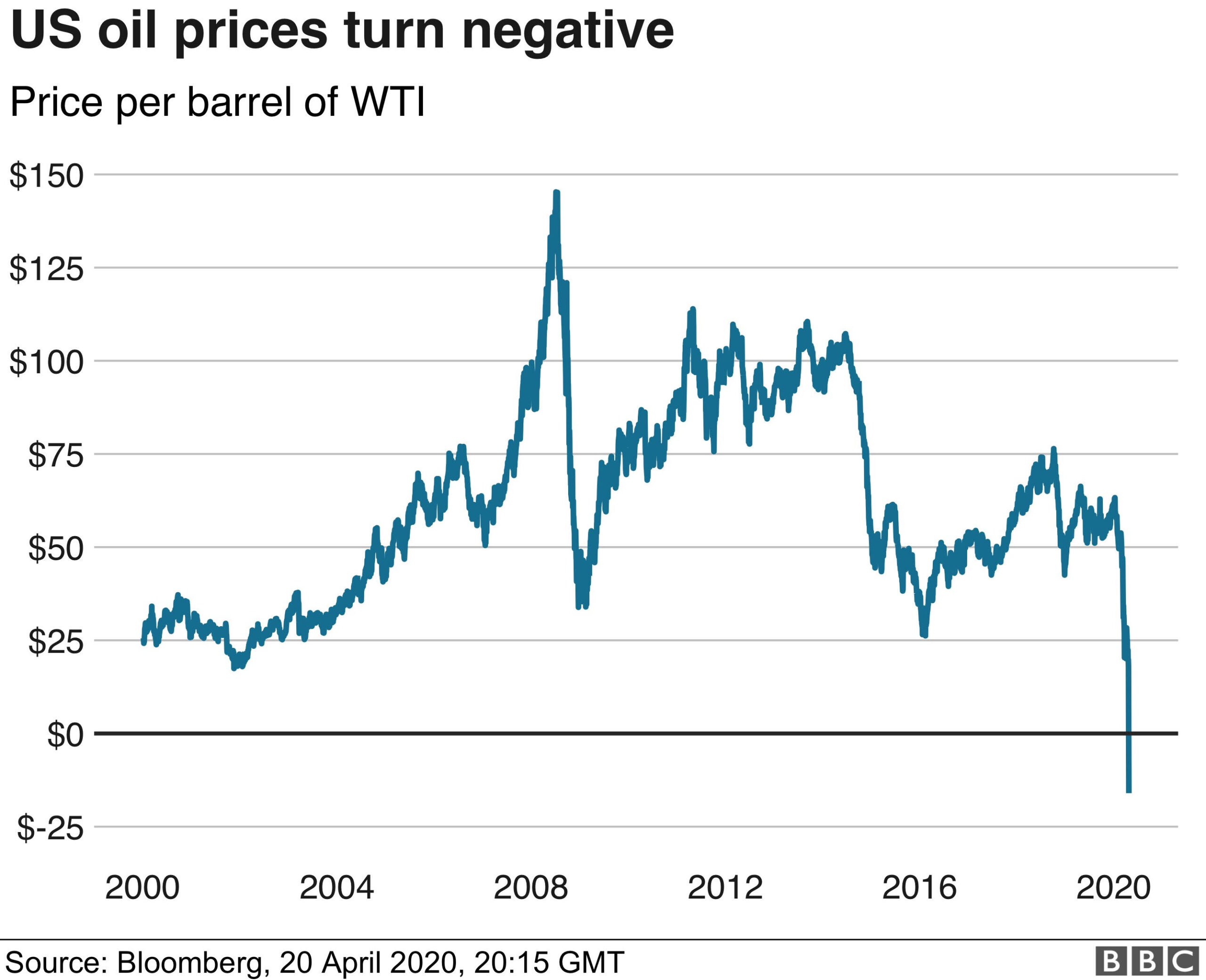

When I got a news notification this afternoon, I’ll be honest, I was planning on not even reading it….but then I saw the title: “Oil Prices Plunge Into the Negatives.” Excuse me, what? I almost choked on my Cheez-It. But low and behold, much like Shakira’s hips, the headlines didn’t lie. So how can a multi-billion dollar industry find themselves in the red? I will break it down for you.

Monday, April 20, 2020 the West Texas Intermediate (one of the most commonly traded oils on the market) found themselves trading at $.19 a barrel. No less than an hour later, WTI was trading at -$36.15. Yes you read that correctly, -$36.15. Which means WTI is basically PAYING traders to take the oil – which is a first. I follow the energy industry pretty closely (for obvious reasons) so I understand the WHY’S behind this event (never anticipating this however) but for those of you who don’t follow the industry, I’ll happily do a brief recap.

The Coronavirus pandemic has driven demand into the ground. – Businesses have ceased operations, people aren’t going anywhere. The entire world as you know is on hiatus. Since we are using less oil, demand for the oil diminishes.

We already had stockpiles before the pandemic.- Pandemic aside, we were sitting pretty on the oil front. We have had relatively moderate weather and oversupply. Which creates a good pricing environment.

The oil industry continued to drill. – This created the perfect storm. When you have extraordinarily low demand, already have a surplus of supply and then continue to drill on top of that – this leads to a storage problem. Traders are spending millions of dollars to stash oil offshore because there is literally nowhere to go with it. Our storage is maxed out.

Storage is maxed out which drives prices down. – What do you do to get rid of something? Sell it for cheap…but what if no one is buying due to a worldwide pandemic? You pay them to take it.

So what does this mean? It’s time to invest. It’s time to invest in renewables now more than ever.

Written by: Kristin DeBias

Sources:

Graph- Bloomberg

Leave A Comment