Energy is more than a price, it’s a direct reflection of weather patterns, world events, and economic trends and falls. If you’ve been paying attention to recent world events (who isn’t) you’ll know that COVID-19 has captivated every news channel, social media platform, and almost every conversation. If you have ventured from your house because you’re an essential worker or needed to buy essential items, you may have noticed gas prices have dipped; my fellow Jersey people- fill up. Now let’s briefly talk about the weather. Mother Nature is no joke and she’s showing us that ignorance of climate change will impact the way the world works. Environmental consciousness that we ALL need aside, our winter season has been showing higher temperatures, storms have increased their impact and frequency, and let’s face it- highs of 75 followed the next day by highs of 35, followed by 60s and random hale in the Tri-State area, in April, is not normal. So what does this mean for energy? Market volatility to the max.

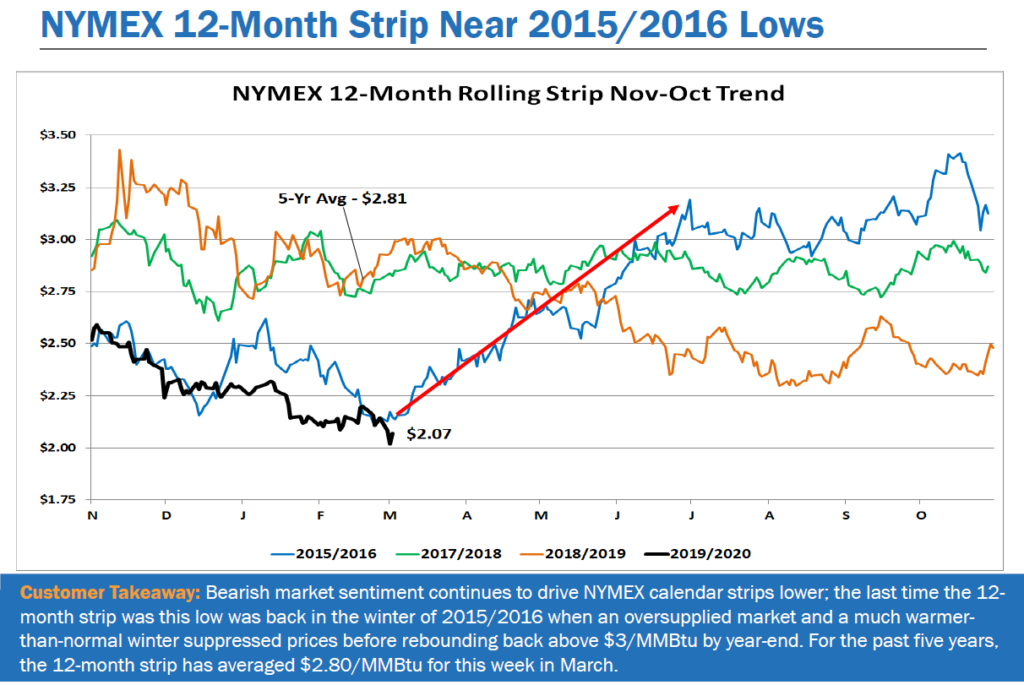

In our previous market update, which you can also find on our website under “Energy Updates” we spoke about the current market lows we are now experiencing. Good for us and good for our clients, but you need to know how to play the market and watch the trends- we have you covered. Natural gas, which directly affects electric, is currently averaging $2.07/MMBtu, while the past 5 years has averaged $2.80/MMBtu. Take a look at this NYMEX graph to see current 12-month strips compared to previous years.

This low will not stay though. Oil.com summed up some great information for us including this statement from data analytics company Enverus– “natural gas prices will exceed $4/MMBtu and could reach $4.50/MMBtu as early as the coming winter.” Enverus also talks how “reduced drilling, frac holidays, and collapsing rig counts are set to reduce U.S. oil production and, with it, the associated natural gas production.” Market lows followed by quick price increases show the serious volatility of the energy market. Our advice: buy now, be in the know with market trends, and give us a ring (do that first).

Written by Eva Gerrits

Information from:

Tsvetana Paraskova for Oilprice.com

NYMEX – CME Group

Leave A Comment